|

EME Myanmar has invested an undisclosed amount in local call center Lan Thit Masterpiece Limited (LML), marking EME’s fourth investment to date. La Woon Yan (Senior Investment Analyst at EME Myanmar) with Hpauje Kai Hkawng (CEO at LML)

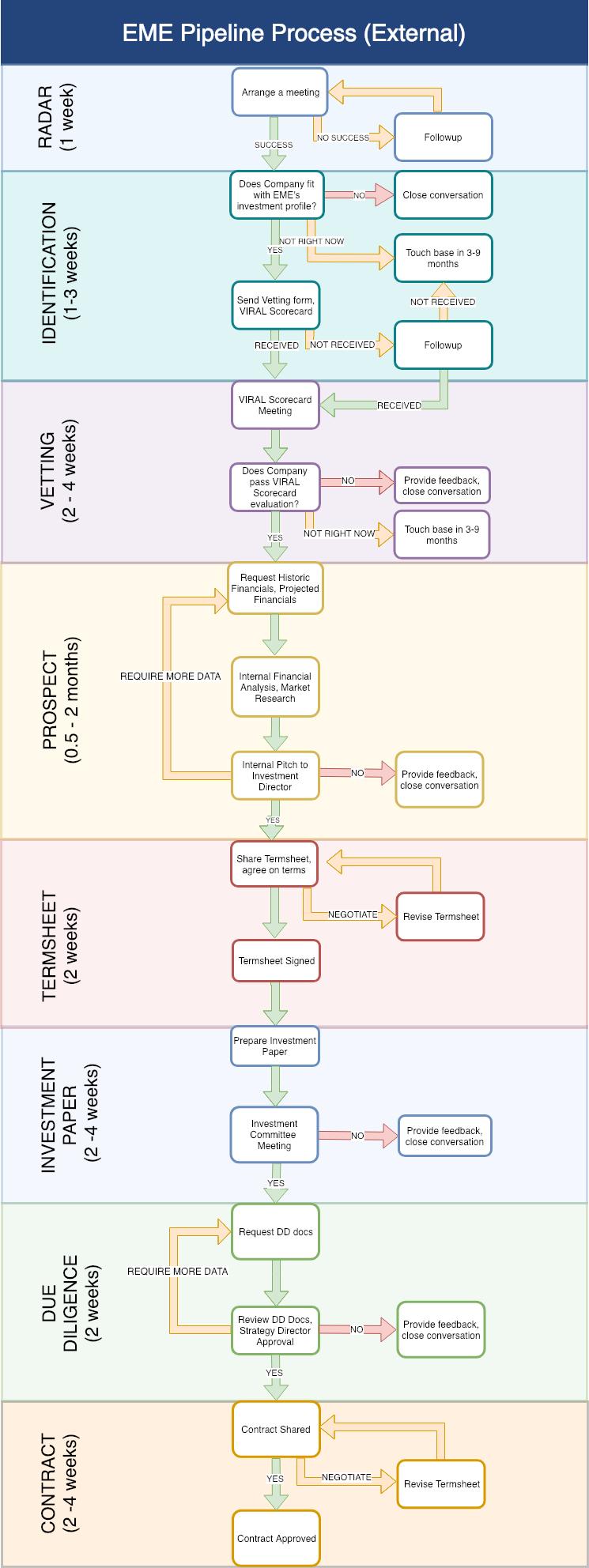

LML offers a range of outsourcing services, including inbound and outbound customer service, sales, data entry and ground marketing. The company started operations in May 2018, and already serves several large multinational clients with significant customer bases. LML draws on the support and expertise of its founding investors: Masterpiece Group, a large Japanese outsourcing company, and Bagan Innovation Technology, a local tech giant famous for its keyboards and e-book store. The company is based in MICT Park and headed by Hpauje Kai Hkawng, a Myanmar national who ran one of Masterpiece Group’s call centers in Japan for 9 years. EME’s Investment Director Hitoshi Ikeya commented, “The time is right for a new call center in Myanmar. Companies are spending more on customer support as competition heats up, and consumers want better service. While hiring entry-level staff to handle customer service is cheap, LML offers a robust solution that saves money over the long term through better reporting, reduced overheads and fewer complaints.” EME will provide LML with sales training, mentorship and introductions as part of its active investment philosophy. EME’s Q&A with Hpauje Kai Hkawng (CEO of LML) What kinds of services does LML offer to companies? LML provides business process outsourcing, focusing on call center services, alongside market research, customer surveys, ground marketing, and social media management. Why should companies choose to outsource their customer service and sales to LML? It can be difficult for companies to build good customer service teams in-house, and knowledge is often lost when employees leave the company. By using LML, companies can focus solely on their main business, without worrying about customer service. As a specialist in customer service, LML knows customers' requirements better, listens effectively and can analyze the customer trend based on customers' feedback. How will EME help LML to grow? EME will help with general market awareness and economic analysis, so that LML knows which industries to target for potential clients. In addition, EME will help oversee the sales process, providing connections to international business. and potential clients. What is your vision for LML in the next 5 years? We aim to be the leading call center in Myanmar, known for our quality guaranteed customer service. We want to fill 200 seats, and provide high living standards for our employees. How will LML change the customer service / outsourcing landscape in Myanmar? Currently call centers in Myanmar are mostly one-way; they don’t prioritize listening to customers. LML will put the customer first, making sure that customers always receive friendly and trustworthy service. About Masterpiece Group Masterpiece Group, Inc., originally established in Japan, has over 25 years experience in BPO services. Since 2000, they have expanded throughout China and Southeast Asia; totalling 12 operating centers across 7 countries, supporting 10 languages and over 200 clients worldwide. They focus on the development of specialized BPO services in Asia centered on the world’s major languages: English, Chinese and Spanish. Fundraising for an early-stage startup is hard. Entrepreneurs spend lots of time crafting their message, making decks, networking, pitching and responding to requests for further information, all the while building a product and growing a team. And after several months of hard work, entrepreneurs may end up with nothing for all that effort. On the other side, investing in early-stage startups is also hard. Investors meet hundreds of startups per year, and only a small fraction of them will be alive in 5 years. There is little data and lots of uncertainty, and because VCs have investors too, they look for ways to minimize risk and maximize reward. This combination of incentives often leads to a dysfunctional system, where startups and investors both play shotgun, entering into as many conversations as possible in the hopes that one may succeed. Investors may string startups along for many months without making clear decisions, while startups may start fundraising before they are prepared and ready. The main divide to bridge therefore becomes one of communication and expectations. In this light, we have decided to publish our refreshed pipeline process, which aims to be as transparent and productive as possible. By highlighting all the stages and requirements, as well as the decision points, we hope to contribute some clarity on VC investment (or at least, our approach to VC investment). As can be seen from the chart, the process is reasonably complex - the minimum time for an investment is 3 months, although realistically it can take up to 6 or 8 months. There are also five major decision points, with increasing levels of certainty in later stages of the process. Note that this investment process isn’t for everyone - startups select investors just as much as investors select startups, and if some are put off by the complexity, that’s a good indication that a future relationship wouldn’t have worked out. That said, at all times we take our role in the startup ecosystem seriously and will always coach good startups through the process and provide feedback if and when we stop the process.

Taking on institutional capital is a big commitment, but we hope our pipeline process is a positive first engagement, and a taste of the value we can bring to our portfolio companies. We are thorough in our selection just as we’re thorough in the support and mentorship we provide our portfolio. Receiving investment from EME is not the end of a process, but the start of a journey of support, guidance and collaboration that is 100% directed at scaling great startups. Thank you to everyone who came to EME's official launch on October 31 at the Penthouse and helped make it such a success! Over 80 of you came for an evening of networking and celebrating the founding story of EME. We’re excited to be announcing our two initial investments: Joosk Studio is the leading animation and illustration company in Myanmar. Their sticker packs have been downloaded millions of times, and their weekly animation series have regular audiences in the thousands. With a roster of international clients including Facebook, UN agencies and leading corporates, as well as a talented team of young designers, Joosk is defining the new wave of digital entertainment in Myanmar.

CarsDB is the #1 online platform for buying and selling cars in Myanmar. Founded in 2012 by an experienced team of local repatriates, CarsDB has grown into the undisputed leader of a rapidly growing market. With a wide range of services including classifieds, offline auto shows and product listings, and plans to expand into insurance and car rentals, CarsDB is the hub of everything automobile-related in Myanmar. It’s been a long road since our founding investors met in 2015 and decided to launch a new Myanmar-focused fund. After much hard work, the partners have developed a compelling vision and set of resources for supporting young Myanmar entrepreneurs to build transformational companies. We’ve met over 100 companies and organisations since commencing operations at the beginning of 2018, and will continue to engage actively with the community through meetings, events and workshops. As part of our launch, we’re also kicking off our official blog and monthly newsletter (subscribe here). With a mix of opinion, data analysis and curated news articles, we hope these will become valuable resources for the startup and investor communities in Myanmar. As always, we are very open to feedback and requests so tell us what you’d like to hear more about. Please don’t hesitate to reach out if you’d like to know more about EME or the startup ecosystem in Myanmar, or want to discuss opportunities to collaborate. All the best,

|

Categories

All

Archives

September 2020

|

RSS Feed

RSS Feed