|

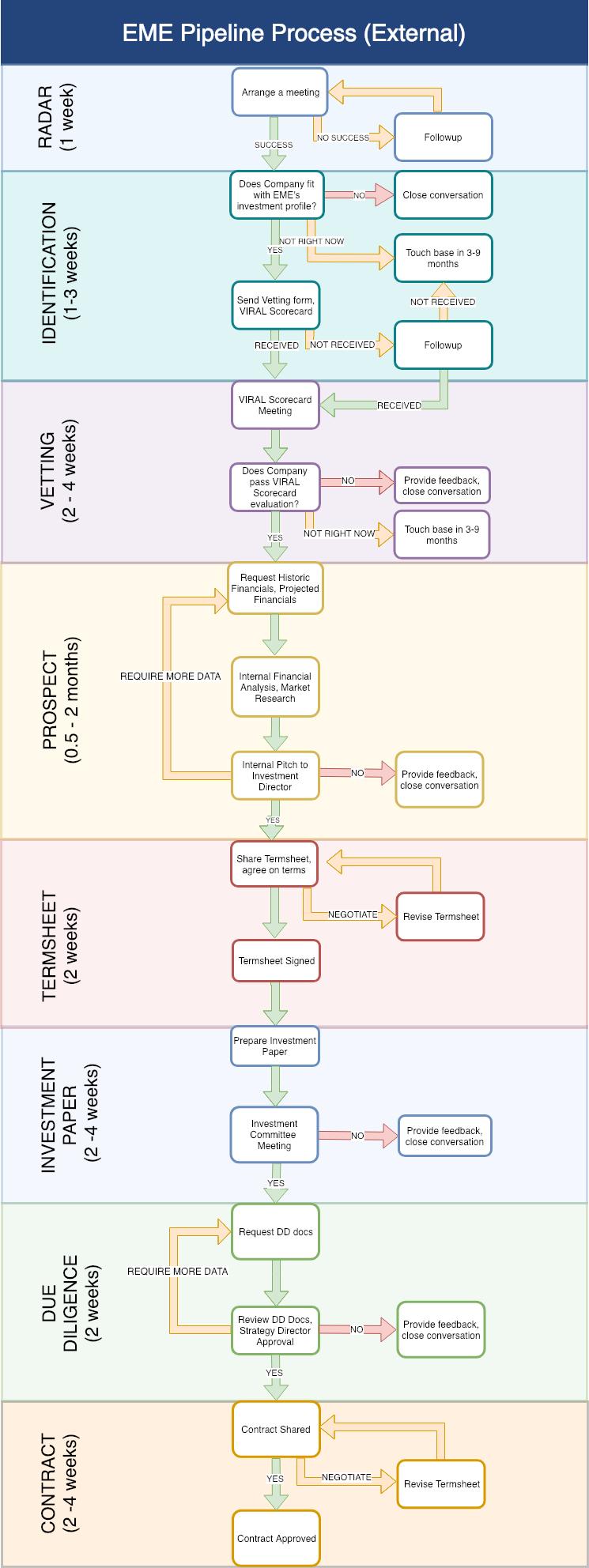

Fundraising for an early-stage startup is hard. Entrepreneurs spend lots of time crafting their message, making decks, networking, pitching and responding to requests for further information, all the while building a product and growing a team. And after several months of hard work, entrepreneurs may end up with nothing for all that effort. On the other side, investing in early-stage startups is also hard. Investors meet hundreds of startups per year, and only a small fraction of them will be alive in 5 years. There is little data and lots of uncertainty, and because VCs have investors too, they look for ways to minimize risk and maximize reward. This combination of incentives often leads to a dysfunctional system, where startups and investors both play shotgun, entering into as many conversations as possible in the hopes that one may succeed. Investors may string startups along for many months without making clear decisions, while startups may start fundraising before they are prepared and ready. The main divide to bridge therefore becomes one of communication and expectations. In this light, we have decided to publish our refreshed pipeline process, which aims to be as transparent and productive as possible. By highlighting all the stages and requirements, as well as the decision points, we hope to contribute some clarity on VC investment (or at least, our approach to VC investment). As can be seen from the chart, the process is reasonably complex - the minimum time for an investment is 3 months, although realistically it can take up to 6 or 8 months. There are also five major decision points, with increasing levels of certainty in later stages of the process. Note that this investment process isn’t for everyone - startups select investors just as much as investors select startups, and if some are put off by the complexity, that’s a good indication that a future relationship wouldn’t have worked out. That said, at all times we take our role in the startup ecosystem seriously and will always coach good startups through the process and provide feedback if and when we stop the process.

Taking on institutional capital is a big commitment, but we hope our pipeline process is a positive first engagement, and a taste of the value we can bring to our portfolio companies. We are thorough in our selection just as we’re thorough in the support and mentorship we provide our portfolio. Receiving investment from EME is not the end of a process, but the start of a journey of support, guidance and collaboration that is 100% directed at scaling great startups. Comments are closed.

|

Categories

All

Archives

September 2020

|

RSS Feed

RSS Feed