|

Above: John Lim, ARA Asset Management (photo credit: DealStreetAsia) We packed our bags and headed to clean and pristine Singapore to meet with and hear from leading regional investors and founders at the DealstreetAsia™ PE-VC Summit 2019. Arriving at the conference, we quickly noticed that we were in a very select minority of investors from Myanmar – an indication of the country’s early frontier status. People were curious about Myanmar and excited to hear about our work and our incredible portfolio companies. Over copious coffees and one or two beers, we shared, listened and learnt. This short post summarises some of the key insights from the presentations, conversations and gentle persuasions of the event. Underlying each of the following points are three core values we observed from the summit: know your customers and put them first, work hard and smart, and lastly, find an investor you can build a relationship with.

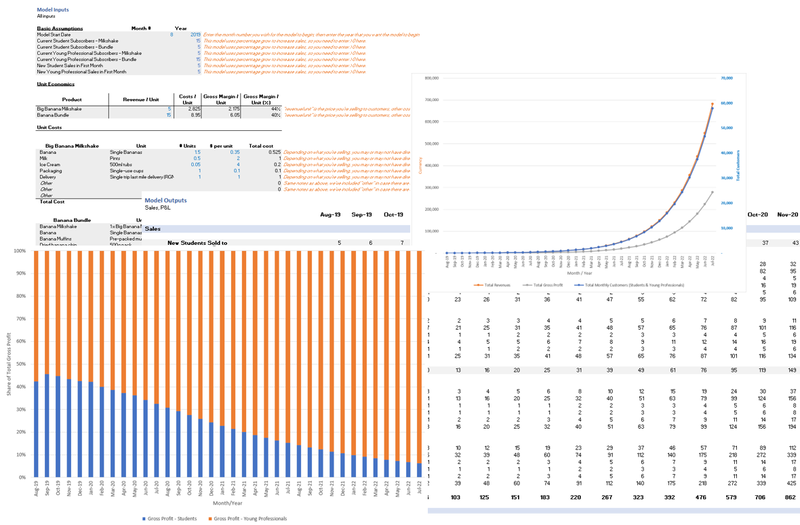

Lesson 1: Don’t Try to Make Money One thing we weren’t necessarily expecting to hear at an event where the total assets under management of all parties was over $100bn was “don’t try to make money”. However, founder and CEO of Deskera, Shashank Dixit told a roomful of investors and founders to focus on building great companies that serve customers and let the money follow. We see value in this sentiment: startups need to deliver outstanding value to their customers - with scaleable unit economics - and if they succeed then exponential growth will happen. Once your product or service is too good to be without, you’re set on a course for scale; so long as you scale with the right unit economics, the riches will come. Focussing on making money, on the other hand, isn’t putting your customer first and introduces short-termism that could prevent you from building something great. Indeed, EME’s permanent capital approach (rather than a fund with an exit deadline), means that we can work with entrepreneurs to build great companies and take a long-term view with founders. Lesson 2: The Importance of Trust One of our favourite one-on-one on-stage discussions was the interview with John Lim. Son of a schoolteacher, John Lim is the cofounder of ARA Asset Management which has $58 billion in assets under management. Lim spoke about how crucial trust was in long-term business relationships, citing that he had a long-term multi-billion-dollar arrangement based purely on a handshake. This introduces an interesting thought experiment: would you trust your partner to honour the agreement purely on a handshake? Often the answer is “no”, which is why we have contracts and may be fine for short-term transactions. When it comes to investing, though, we want to be able to treat contracts as a formality, understanding that there is an enduring trust between us and those we invest in. This approach forces transparency, accountability and integrity on all parties, which can only be a good thing. Keep this in mind next time you review a term sheet. Lesson 3: 007, not James Bond China’s growth has been built in part upon the 996 model: people working diligently from 9am until 9pm, six days a week. This might feel quite gruelling for the employed, but for founders John Lim says they should be following the 007 model. 007, in case you haven’t worked it out yet, is 12am-12am, seven days a week (i.e. 24/7). Of course, even Elon Musk sleeps (a little), but the sentiment is that to build something great, founders must commit and put in the work. In fact, when asked about the secret sauce for founders, Lim offered: there’s no secret sauce for startups or CEOs. They must be passionate, know their stuff, be patient and work hard. He added: “Don’t open a restaurant because you love food. If you want to start a restaurant, work in one, understand the customers, the supply chain and the problems; after a couple of years, only then might you be ready.” Lesson 4: Vision Without Execution is Hallucination Southeast Asia is creating more and more unicorns (startups valued >$1bn), but these companies are coming from great execution more than they are fresh innovation. Given that SEA is quickly developing, there is significant scope to take models born in Silicon Valley or elsewhere and transplant them into these markets. Investors and founders at the event agreed: SEA is an execution game. This is as true in Myanmar as anywhere else and perhaps even more so given the country’s only very recent emergence from military rule. In Myanmar, there are plenty of opportunities to disrupt traditional business with nimble ideas from other markets. How to execute? This requires excellent founders who can deliver on their strategies, who can roll up their sleeves and make things happen, who have a drive and determination to ensure dreams become reality. Decisions might happen in the boardroom, but the real work takes place on the ground. Lesson 5: The days of investing and taking a backseat are over Investing in startups is becoming increasingly competitive. With a challenging global economy and more funds available for a greater array of startups, investors are reflecting on the role they play. Across many conversations and panels, a theme emerged that simply betting on a founder and walking away, hoping they succeed, is a dying strategy. Founders expect their investors to become partners, not just cheque books. In Myanmar, there is less capital than most markets in SEA but this doesn’t mean founders need to be happy just accepting cash. In fact, EME’s model is based on investing capital and significant time into our portfolio companies – helping them to overcome their challenges and find a pathway to scale. Agree, disagree or have additional lessons to share? Drop us a line at [email protected]! A good financial model is a little bit like magic. You can gaze into the future and compare how decisions you make today affect what happens for years to come. Of course, even the best financial model is only a representative of what could happen. None of us can truly see into the future, try as we might. What makes a “good” financial model? A financial model is just a business tool, so a good one is one that gets the job done. It should be error-free, clear to use and provide results that are easy to interpret. Similarly, you need a different tool for different jobs; the financial modelling requirements of a listed company are going to outweigh those of a young startup.

When we planned this post, we were intending to share a financial model template that we’d found online and provide some usage notes / pro tips. However, it turns out that there is a dearth of appropriate models that are ready to use by reasonably inexperienced people. The models we came across were either overcomplicated or very limited, so we decided to create our own! You can download our subscription model template at the bottom of this post, and below you’ll find some good modelling principles to help you make your own. Garbage in, garbage out The first rule when creating projections of any sort is: garbage in, garbage out (GIGO). This simply means that if you make wild or erroneous (or both) assumptions when putting information in, you can only expect to get wild or erroneous results out. If my model says I can take 10% of the total addressable market, but I get the market size wrong, my model will be wrong. This means that the initial research behind your figures is crucial. Research your inputs and check your assumptions as much as possible before entering them into any financial model. You can be sure that investors will ask, “how did you get to this number?”, so be ready to defend your projections. Top down vs bottom up Check out our recent post on top-down vs bottom-up approaches to market sizing. With financial modelling, we also want to start at the bottom and work back. For instance, if you simply estimate your sales are growing at 10% month on month, you can quickly miss the underlying details. Your sales are unlikely to grow for no reason. More likely, you have marketing and sales expenses that together help drive sales. At the very least, you need to consider in detail how your HR, marketing and related costs are going to contribute to increased sales. Rather than assume sales grow at 10% and sales staff expense grows at +1 person a year, ask how many sales one salesperson can make in a month then multiply this out to the year, then work up to sales output. KISS Keep it simple, stupid (KISS) is a design principle that is clear to understand: keep things as simple as possible, so that they’re easier to use. This goes for financial models too: separate your inputs clearly, build your model logically and add notes wherever necessary. Adding usage notes is not only good practice for any spreadsheet design, but it'll help you understand what you've done so far, in case you start to get stuck with your model. If you make a good pitch to an investor, there's every chance they're going to want to see your financial model - so it's good for it to be clean and easy to read. Use charts effectively Don’t rely on people to read hundreds of lines of your model. If your model requires complex calculations that’s fine, but these rows shouldn’t be used to present information. In our template, there are “inputs” and “outputs” plus some charts. This is to keep things straightforward (and our outputs are only 100 lines or so). Another approach is to model sales and revenues separately to costs and then to present the outputs of these sheets in a summary sheet. Whichever you do, it’s advisable to add some charts to show what’s going on in the model. If you haven’t seen it yet, check out our quick guide on what makes a good chart. Build what you need, then stop Think about building your financial model like building a ladder. You need enough information (rungs) for your purpose. You might even add a few extra rungs, to make it easier to get on and off the ladder at the top. But if you keep adding rungs, you’re going to have a very large ladder that’s cumbersome to move around and doesn’t offer much beyond the much smaller one that suits your need. Financial models can go on and on, but there comes a point where adding more variables isn’t necessarily making your model any more accurate. If the model represents key costs, how you acquire customers and how you generate income and adapts to show different outputs based on your input assumptions, it’s probably all you need to begin with. Remember, the more complex something is, the easier it is for errors to hide. It’s better to have a simple and correct model than a complex and wrong one. You can download our basic subscription financial model here. Our intention isn’t to provide a one-size-fits-all model (does such a thing exist?) but rather to guide founders on how to go about representing their business model in spreadsheets. The best financial model in the world won’t grow your business, but clearly laying out how your business makes money should help you make better decisions. Good luck! Above: the EME team (after we escaped) Last Friday the EME team headed out to Xcape Squad, one of Yangon’s escape room venues (they’re not sponsoring this blog). After we escaped, we reflected on some lessons that also apply to founders and startup teams. For those that aren’t familiar with the escape room format: a small group of people is locked inside a room and must solve several clues to unlock the door all within an hour. The time pressure and limited information forces a need for communication and collaboration, something that startups will appreciate as they face pressure to grow / raise before the money runs out.

Here’s what we learnt: #1: Map Your Surroundings Before starting off in the wrong direction, it’s important to understand your surroundings – your market, competition, customers. You might have what feels like a great idea, but until you’ve spent time checking your assumptions, your great idea is unqualified. When we got into the room, we found several long sticks and immediately started seeing where they would fit – but there was a very big clue that we missed for a while because we hadn’t properly assessed our surroundings. Startups sometimes make this same mistake by missing crucial elements that affect the viability of their model. To avoid this, ensure you’re consciously aware of who your company is serving, why it’s serving them and why they would use your service over any other. #2 Don’t Forget Fundamentals Escape rooms force you to solve clues in order, but before we learnt this, we were flailing around trying to solve several clues at once. Startups should be fast and nimble, able to race ahead. But, even the fastest startup needs some key fundamentals in place and missing these is going to cause severe growing pains later down the line. Yes, we’re talking about clear financial reporting, sales tracking, customer management, staff management, etc. It’s important that there are at least basic and functional systems in place as a foundation to grow upon. Whether its simple spreadsheets or free / freemium software, it’s also important to keep track of what you’re doing. How else are you going to show your achievements? How can you ensure you’re making the right pivot without a clear record of what’s happened so far? #3 Have a Plan and Embrace Horizontal Structures When there’s just three of you, it’s a good idea to ensure that anyone with a smart idea can bring it to the fore. This is as true for the escape room as it is for business, and it’s not just limited to three people. In a startup you’ll have a small number of people (at least to begin with) with different skillsets and in different positions. Firstly, everyone should understand what the company is working towards and how to get there. Second, this plan should be changeable if new information is presented – by staff at any level. Sales people know why customers are or aren’t buying, the customer service team knows what customers like or dislike about your products / services, the marketing team knows how to advertise key messages, and so on. While the CEO should be plugged into these things, it’s also the CEO’s role to ensure that all staff have a voice and can contribute to achieving or altering company goals. #4 Get Advice To quote one famous sports coach, “In life, you need many more things than talent. Things like good advice and common sense”. We had three opportunities to get help with clues and we used every one. Getting hints to solve clues helped us move faster when we hit a roadblock. This is the role that mentors, advisors and board members (we’ll call them all mentors for now) should play for startups. It’s the founder(s)’ role to find good mentors and “good” is going to be different depending on the startup need or company stage: it could be someone from the industry that brings connections and technical knowhow, or a venture capitalist with ability to help raise additional funding, or simply someone with experience to help bounce ideas off of. #5 Celebrate Wins, But Keep Going When we solved a clue, we high-fived and patted ourselves on the back but as we were against the clock, we soon moved on. Startups should do the same. It’s going to be hard to scale your business and all the odds are against you, so celebrate wins even when they’re small. Celebrate big wins too but – and this especially relates to what you might see as big wins – celebrate then keep going. It is not the role of the startup to get comfortable. Comfort is for the slow-moving corporates. If you’ve raised money, it’s time to work double as hard to ensure you deliver to investors and have them re-invest or help you find investment to scale further. There might not be a clock ticking down to zero in your office, but be sure: you are against the clock, if you don’t move fast enough then someone else will. |

Categories

All

Archives

September 2020

|

RSS Feed

RSS Feed