|

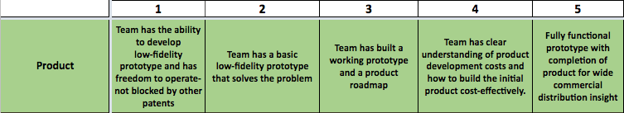

Evaluating early-stage startups as an investor is hard. Giving constructive feedback is even harder, at least if you want to say more than ‘Cool idea’ or ‘You need more traction’. That’s why at EME we use a tool called the VIRAL Scorecard, originally developed by the folks at Village Capital, to be more rigorous in our conversations with startups. Before we dive into how it works, it’s worth emphasizing that this is a discussion tool, not an objective, quantitative measurement of a company’s worth. Data scientists out there may wish it was possible to measure a couple of key indicators, feed them into a model and predict which companies will succeed, but that’s not how early-stage companies work. JFDI, an early-stage VC in Southeast Asia tried to do just that with their Frog Score index, but abandoned it after finding zero correlation between how highly a company scored on their index and how well the company did later on. Instead, the VIRAL Scorecard tries to create a framework for a structured discussion about each aspect of a business. The VIRAL Scorecard describes a number of dimensions of a business including Team, Product, Market etc. Each dimension has 10 stages, with criteria for each stage. Let’s take a look at the first couple of stages in the Product dimension: The scores are cumulative, so if you meet the criteria for stage 4, you should also meet all the previous criteria. It’s important to note that the criteria are somewhat subjective - what is the difference between ‘low-fidelity prototype’, ‘working prototype’ and ‘fully functional prototype’ for example? Here’s how we use the tool when we talk to a startup:

In the meeting, we go through each component of the VIRAL Scorecard, first asking the startup to share their score and reasoning. Then we’ll share our score, and ask follow-up questions. If the scores are similar, great, we’re on the same page. If the scores are very different, that tells us one of two things: EME and the startup has access to different information: As investors, we will know less about the business than the founders, and our scores will reflect that. At an early stage, we probably won’t have seen detailed financial projections or customer feedback. Conversely, sometimes we will know more about an industry and what the competition is doing than the startup. If this is the case, we’ll have a discussion and often revise our scores. EME and the startup have different understandings of the fundamentals of the business: Sometimes startups will try to score themselves as high as possible, in the hope that this will make the company seem more attractive. It’s a reasonable approach when faced with a scorecard, but often has the reverse effect. We want to companies to be aware of their limitations and current state. We’re less interested in the final score and more in constructive dialogue. In this meeting, we’re really trying to get a sense of how the founders think, and how we could work together. It’s a cliche that venture capital investors invest in people rather than companies, but that’s particularly true for early stage startups, which could be several pivots away from their eventual model. This conversation is potentially the beginning of a long-term relationship between the investor and the start-up, and like all relationships, good communication and shared values are essential. These conversations are good for digging deeper into the fundamentals of the business, and often reveal things that we hadn’t even thought of asking about. The VIRAL Scorecard is also helpful in providing concrete points for feedback. Instead of saying things like “You’re too early-stage”, we can say “We’re still unsure about your business model, and we’d like to see some more work done on your unit economics”. We invariably learn a lot from these conversations, and we think they are useful for startups too. At the end of the day, the final score doesn’t really matter - what matters is the quality of the discussion, and the shared understanding that has been created. Comments are closed.

|

Categories

All

Archives

September 2020

|

RSS Feed

RSS Feed