|

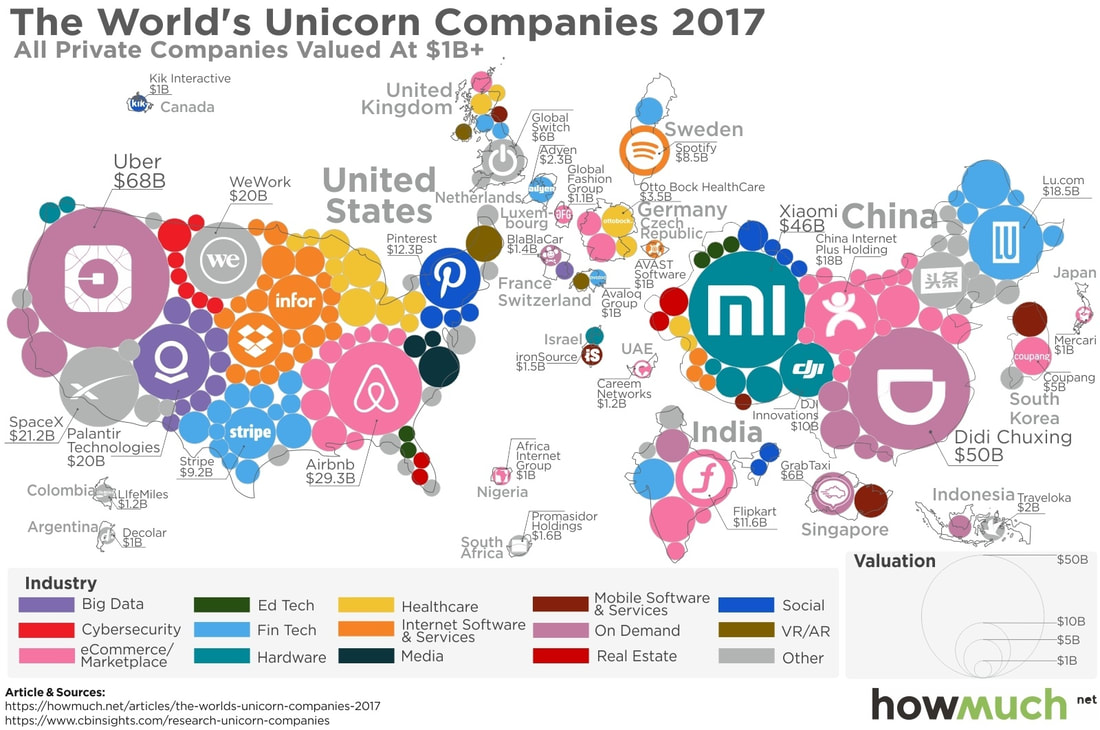

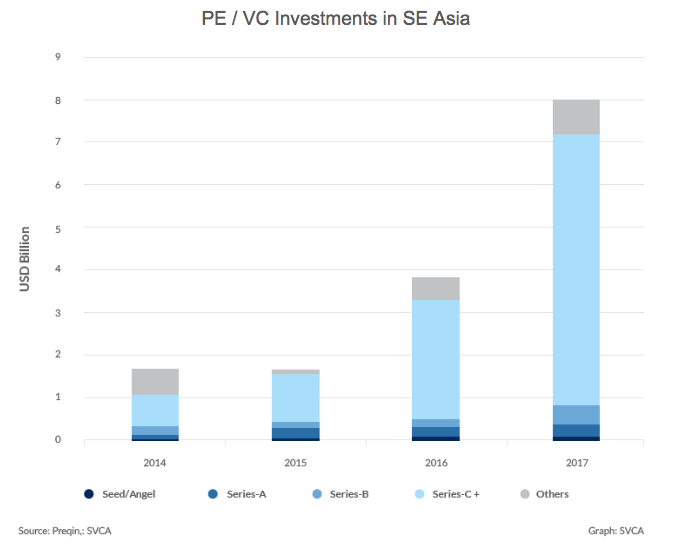

We have an office bet going on here at EME. Over lunches at MICT Park and long cab rides to downtown, we discuss the following proposition: Myanmar will create a unicorn (a company with a valuation over $1 billion USD) within the next 5 years. The stakes are a round of beers for us and possibly much higher for the market at large. Disclaimer: we’re not talking about existing companies or prospective investments (that’s a separate bet), so much as the overall trends and market conditions that would allow a unicorn to emerge. As anyone who has stood in line at a Myanmar government office can tell you, there are significant structural challenges for startups to solve. Nevertheless, the population is large, young and increasingly digitally-connected, and as McKinsey suggests, the economy could enjoy years of strong catch-up growth over the next decade in line with other countries in the region like Indonesia and Vietnam. This creates a long-term opportunity for a local tech company to grow into a unicorn. Sector-wise, the startup would probably be in transportation, ecommerce or fintech. All of these sectors have large market sizes, viable business models and can use technology to scale. While other sectors (healthcare, education, logistics etc) also have large potential markets, they are often more challenging to digitize and/or monetize. For funding, this prospective unicorn would probably get seed investment from angels and local funds like EME, then tap regional VC funds and family offices for Series A / Series B. Corporates and later-stage PE/VC investors e.g. Alibaba, Softbank, Sequoia, would fill out the later rounds. Investors are increasingly interested in Southeast Asia and have a lot of unspent capital. As long as this prospective unicorn could demonstrate strong user growth and potentially expansions to other countries in the region, access to finance wouldn’t be an issue. Of course for the purposes of the bet, the potential unicorn would have to avoid getting acquired before reaching that magic $1b valuation. Even after reaching unicorn status, a company may stay private for many years (now often referred to as the Softbank Effect after SoftBank’s $100 billion Vision Fund). Acquisitions by major global platforms seem to be preferred to IPOs at present. Nevertheless, the recent listings of Sea, Razer and Kioson prove that IPOs can be viable for Southeast Asian technology companies.

Overall, we’re very optimistic about Myanmar’s prospects for a unicorn in 5 years. As long as startups continue to work hard, engage users and build products that generate real value, the chances are good that a local player can grow sufficiently fast to achieve unicorn status. It may come as no surprise then, that EME is investing in and supporting early stage tech companies. If you want to join the bet, take our poll on Facebook. See you for beer in 5 years. Comments are closed.

|

Categories

All

Archives

September 2020

|

RSS Feed

RSS Feed