|

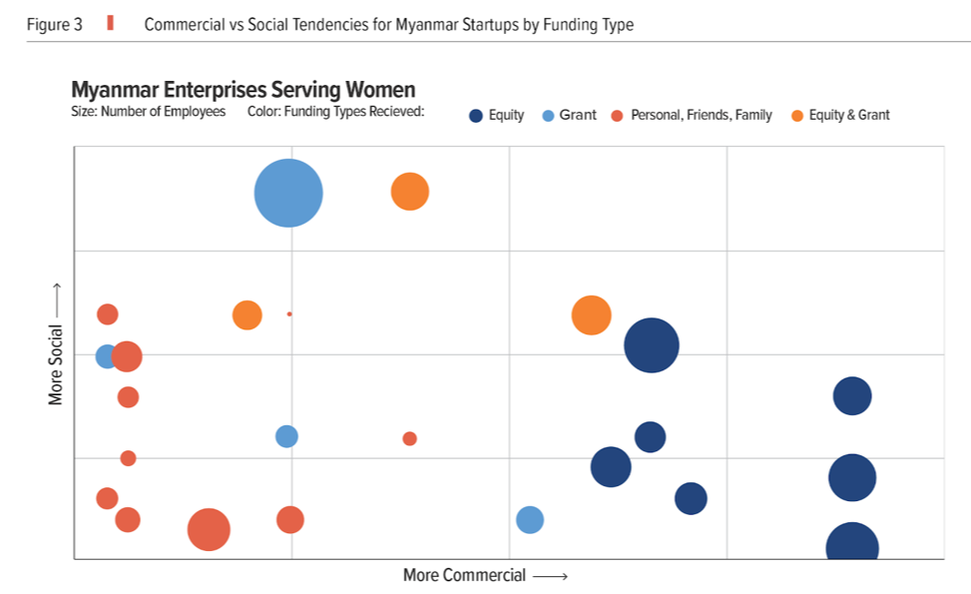

Publishing research is important to shifting the ideas and frameworks that exist within any context, but it's often the role of thinktanks or research agencies. Why then, you might ask, is EME co-publishing this latest report? The answer is simple: across some of our latest investments we've seen a range of businesses putting women at the centre of their business models; from Yangon Broom employing low-income women, Ezay helping rural businesswomen, and Kyarlay whose customers are majority women. Therefore, when we learnt of the Sasakawa Peace Foundation's interest in learning about how entrepreneurship can help close gender gaps in Myanmar, we saw an opportunity to expand our knowledge while studying an ecosystem we know and love. To supplement our knowledge of gender and entrepreneurship, we teamed up with Support Her Enterprise for this study as they work solely with women micro, small and medium enterprise owners to help grow their business. In this report, we survey innovative businesses (typically "startups") with a focus on women and / or girls. These businesses were led by women and / or men, but targeted women either as employees, part of the supply chain or as customers. We also dived deeper into ten case studies with Myanmar women-focussed businesses to learn more about their founding background, approach and outlook as well as their challenges to growth. Finally, we surveyed rural businesswomen to understand the challenges of "necessity-entrepreneurs" and because all women surveyed were buying services from innovative enterprises (indicating that this group of women can afford to pay for services that help them improve their livelihoods - a great indicator that Myanmar is ready to support new and innovative businesses that serve the mass market). Thanks to shared values between the EME and SPF teams, the resulting data of this rural survey is available for all in this online dashboard! The full report is available here in English, and the Executive Summary is available here in English and here in Burmese. Below we've picked out just one of many findings, in no small part because we like bubble charts but also because it raises an important point for young socially focussed startups looking to grow. In the above chart we position companies based on how social or commercial they ranked by our analysis and by what type(s) of funding they had received. The results are quite clear:

1. Bottom Left Red(ish) companies: companies without formal funding tend not to have processes / traction that might help show them as more / less social or commercial. 2. Right Dark Blue: companies who have raised equity tend to be more commercial with a range of how social they are. 3. Middle Light Blue and Middle Orange: Grant-backed companies were more commercial than those without formal funding and in the cases when companies receive grants and equity, they tend to be more social than those only having received equity. What does it all mean? Well: "you are what you eat". Or, put another way: not all money is created equal and any money a startup raises will have different conditions. It's not our role here to comment on which funding is "best" or "most suitable", the answer changes for different companies and may change over the course of a company's lifecycle (and as a VC, EME is probably biased to equity anyway). The orange dots on the chart above may indicate that there is an enabling role in providing grants to startups to help them raise commercial capital. But we also noticed that if a company gets too acquainted with income sources that don't promote sustainability then they may struggle to become lean enough to scale (seems obvious huh?). We at EME believe that scalability is fundamental to impact and commercial growth and it is our role and the role of any ecosystem enabler to help companies work toward sustainable scalability (i.e. positive unit economics). Other findings include: even among the women-focussed businesses surveyed men raised more equity than women; the average costs of a startup is... [see the report!]; and lots of companies like to say they're "social" but only two-thirds actually measured their social results (similarly, many lacked someone in charge of finances so lack of measurement may be more an indicator of overburdened founders than of not caring). Read the full report here. **Note that this blog reflects only the opinions of EME and readers are encouraged to read the Executive Summary and / or full report for the position of all of its authors**

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Categories

All

Archives

September 2020

|

RSS Feed

RSS Feed