|

One of EME’s favourite taxi conversations is discussing what startup ideas could work in Myanmar. As investors, we meet with many startups and ecosystem players and have a birds-eye view of what is happening (and not happening) in the startup world. In this post, we’ll be sharing some of the business opportunities we see in the market that we’d love somebody to take a crack at. In our previous post on the Startup Idea Matrix, we talked about how startups succeed by trying out new strategies in new industries. In Myanmar, there are many tried-and-tested startup strategies from abroad which haven’t been implemented here yet. In particular, we see a lot of opportunity in subscription-based models, which are inherently more sustainable than transaction-based models. Mobile payments players like Wave and OKDollar are beginning to find traction, and startups should capitalize on the emerging opportunity for frictionless digital payments.

As a disclaimer, each of our proposed ideas would require a lot of additional market research, brainstorming, product testing etc, and success is definitely not guaranteed. Yet that’s what makes them worth trying! Without further ado, our top startup ideas are:

EME Myanmar has invested an undisclosed amount in local call center Lan Thit Masterpiece Limited (LML), marking EME’s fourth investment to date. La Woon Yan (Senior Investment Analyst at EME Myanmar) with Hpauje Kai Hkawng (CEO at LML)

LML offers a range of outsourcing services, including inbound and outbound customer service, sales, data entry and ground marketing. The company started operations in May 2018, and already serves several large multinational clients with significant customer bases. LML draws on the support and expertise of its founding investors: Masterpiece Group, a large Japanese outsourcing company, and Bagan Innovation Technology, a local tech giant famous for its keyboards and e-book store. The company is based in MICT Park and headed by Hpauje Kai Hkawng, a Myanmar national who ran one of Masterpiece Group’s call centers in Japan for 9 years. EME’s Investment Director Hitoshi Ikeya commented, “The time is right for a new call center in Myanmar. Companies are spending more on customer support as competition heats up, and consumers want better service. While hiring entry-level staff to handle customer service is cheap, LML offers a robust solution that saves money over the long term through better reporting, reduced overheads and fewer complaints.” EME will provide LML with sales training, mentorship and introductions as part of its active investment philosophy. EME’s Q&A with Hpauje Kai Hkawng (CEO of LML) What kinds of services does LML offer to companies? LML provides business process outsourcing, focusing on call center services, alongside market research, customer surveys, ground marketing, and social media management. Why should companies choose to outsource their customer service and sales to LML? It can be difficult for companies to build good customer service teams in-house, and knowledge is often lost when employees leave the company. By using LML, companies can focus solely on their main business, without worrying about customer service. As a specialist in customer service, LML knows customers' requirements better, listens effectively and can analyze the customer trend based on customers' feedback. How will EME help LML to grow? EME will help with general market awareness and economic analysis, so that LML knows which industries to target for potential clients. In addition, EME will help oversee the sales process, providing connections to international business. and potential clients. What is your vision for LML in the next 5 years? We aim to be the leading call center in Myanmar, known for our quality guaranteed customer service. We want to fill 200 seats, and provide high living standards for our employees. How will LML change the customer service / outsourcing landscape in Myanmar? Currently call centers in Myanmar are mostly one-way; they don’t prioritize listening to customers. LML will put the customer first, making sure that customers always receive friendly and trustworthy service. About Masterpiece Group Masterpiece Group, Inc., originally established in Japan, has over 25 years experience in BPO services. Since 2000, they have expanded throughout China and Southeast Asia; totalling 12 operating centers across 7 countries, supporting 10 languages and over 200 clients worldwide. They focus on the development of specialized BPO services in Asia centered on the world’s major languages: English, Chinese and Spanish. Fast-growing startups have a lot to think about, survival being top of the list. Yet in the long term, the way a startup manages people is absolutely crucial for success. As Peter Drucker said, “Culture eats strategy for breakfast”. Creating a productive and healthy work environment where employees are empowered is the difference between an average and a great company. From the traditional ‘Human Resources’ to the trendy ‘People Operations’, there have been many approaches to the art of managing people. Yet they all encompass the same basic elements, summarized as follows:

Startups change quickly, and HR is often slow to adapt. A rule of thumb is that for every tripling in headcount, the internal systems of a company need to change. A one-person startup is very different from a three-person startup, and a ten-person startup is yet again different. The goal is to have a balance between structure and flexibility - too many documents, forms and policies and everyone gets bogged down in bureaucracy - too few, and nobody knows what is going on. With all that said, here are some beginner steps to get you started on your HR journey:

We’ve also curated a list of resources that EME has used internally to learn about HR. Note that some of the policies and regulations mentioned in the resources may only apply to specific countries; it’s always worth studying employment law in the country you operate in. From HR to People Ops: When and Why To Start a People Team

Matt Viner (Investment Manager at EME) with Loring Harkness (CEO of Mote Poh) showcasing the Mote Poh booklets We’re excited to announce our lead investment in the seed round of Mote Poh, a Yangon-based employee-benefits-as-a-service startup for Myanmar companies, together with Nest Tech of Vietnam.

Founded in May 2018 by serial entrepreneur Loring Harkness, Mote Poh has grown quickly and now serves over 60 clients, including Yoma Strategic Holdings and MyJobs.com.mm. The company’s mission is to help companies ‘surprise and delight’ their employees through an exclusive rewards book that can stretch employees’ paychecks by hundreds of dollars a month. As an investment firm, we’ve seen high employee churn rates across many industries in Myanmar, and it’s exciting to see Mote Poh tackling the problem head-on. We expect to help Mote Poh grow by consulting on technology and finance, as well as helping them partner with our mentors and companies in our network. Currently based out of the Phandeeyar coworking space in downtown Yangon, Mote Poh is developing a mobile app, and expanding to other types of loyalty programs. It seeks to transform the HR industry by partnering with companies to recognise and reward employees. EME's Q&A with Loring Harkness, CEO of Mote Poh How did you come up with the idea for Mote Poh? Mote Poh is a localised version of employee benefits programs that leading companies in Singapore, the United States and other countries have been using for decades. Many companies in Myanmar provide employees with limited compensation packages: salary, personal income tax, social security contributions, and occasional ad hoc benefits like team dinners. At the same time, many companies have difficulty recruiting, recognising and rewarding, and retaining top talent. I spoke to dozens of company owners, CEOs and HR Managers. I asked them why they didn't provide better benefits to their employees. Their answers were nearly all the same: they fear that implementing an employee benefits program will be time consuming and expensive - and that employees wouldn't appreciate it. So I created Mote Poh - a small book full of 100% FREE items and exclusive discounts at favourite shops, restaurants and activities across Myanmar - to help companies surprise and delight their employees every month. Mote Poh makes employee benefits easy - just great benefits employees love, with no hassle and no big price tag. What impact does Mote Poh create for companies and users? Employees love Mote Poh because the benefits top up their salaries by MMK 50,000 - 100,000 (USD $30 - $60) every month and also help them to discover new events, shops, restaurants and experiences. Mote Poh has benefits for every taste and budget - there really is something for everyone. It’s so much fun to watch employees get their Mote Poh books, flip through all the free and deeply discounted items, and start exclaiming "Thwar meh!" ("Let's go there!”) or "Sar chin dae!" ("I want to eat it!"). Companies also love Mote Poh because it's an effective tool to surprise and delight employees - which makes it easier and cheaper to recruit, recognise and reward, and retain staff. Leading companies know that they need to offer employees a range of benefits to stay competitive and build the best teams. But they can't do it alone - they need partners like Mote Poh who can do the hard work of creating and servicing benefits. Why did you select EME and Nest Tech as investors? EME and Nest Tech aren't your typical "spray and pray" early stage investors. Both firms invest in just a few startups per year, and then leverage their experience, skills and connections to help startups like Mote Poh grow in the years ahead. EME will be providing us with mentoring in financial modelling and data analytics, as well as making some valuable introductions. Nest Tech is seconding us their tech lead to help us build our upcoming mobile app and create our digital strategy. These investors share our vision for exponential growth and offer support to help us reach it. What is your vision for Mote Poh in the next 5 years? How will Mote Poh help change the HR landscape in Myanmar? Mote Poh is currently helping companies surprise and delight their employees every month. In the years ahead, I see us partnering with leading employers to help them build truly inspiring places to work - which promote health, happiness and productivity - and then recognise and reward employees for great performance. This is the first in a series of startup guides that EME will be publishing on key business skills for startups. Marketing - the process of making the customer journey clear and accessible - is perhaps the most important challenge an early-stage company needs to solve. As legendary management theorist Peter Drucker said, Because the purpose of business is to create a customer, the business enterprise has two— and only two— basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs. Marketing is the distinguishing, unique function of the business. We have seen many startups focusing more on product than customers, and expecting the business to grow itself. While this might work in some close-knit or cutting-edge industries, most startups need to develop and master this skill if they want to scale. This is particularly true in Myanmar, where large parts of the population are coming online for the first time. Successful marketing isn’t just about spending money to boost Facebook posts. It’s about defining and executing a comprehensive plan to engage customers across different platforms over time. The chart from Marketing MO below shows just how many business areas are related to marketing, from pricing strategy to design, social media, CRM systems and sales management. Companies that execute a successful marketing strategy can become global stars, almost overnight. For example, ONE Championship, an Asian sports media company founded in 2011, has become one of the biggest destinations for mixed martial arts (MMA) fans worldwide. By combining savvy social media use with high-quality live events and exclusive relationships with local stars, ONE Championship has quickly built a loyal fan base and enduring reputation - read this Forbes article for more of their story.

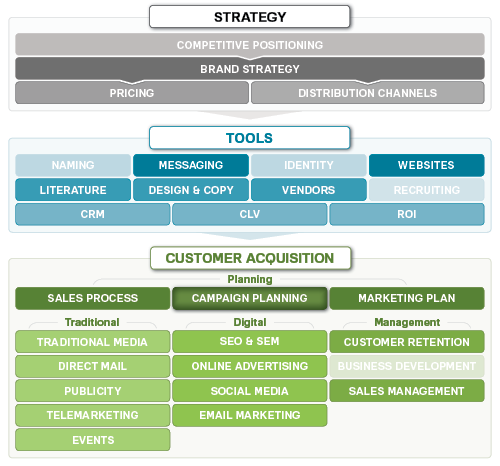

While all this may seem like a lot to tackle, here are a few key steps to get started on your marketing journey:

We’ve also curated the following set of resources that the EME team has personally used to learn about marketing. As with anything worthwhile, some of these resources require significant time and energy. Also note that some of the content is not free, although we will provide access for EME’s portfolio companies. Books are available from the EME Library - please ask for more. Introduction to Digital Marketing

Strategic Marketing for the SME

Digital Marketing for Dummies

Facebook Ads & Facebook Marketing MASTERY 2019

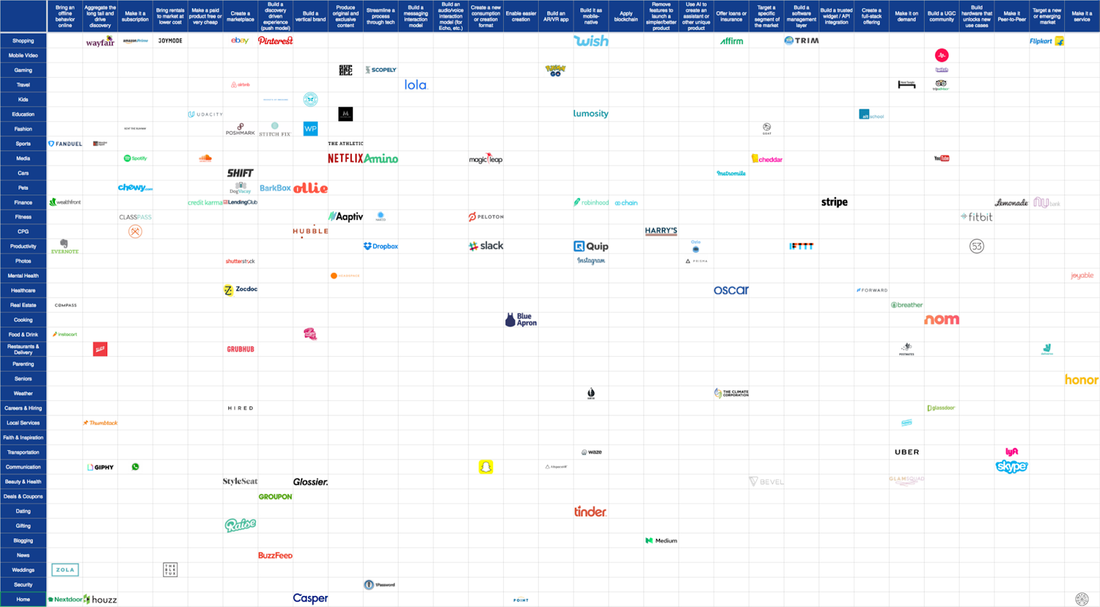

Why do startups exist? Aside from satisfying the financial or social aspirations of the founders, they play a crucial role in the wider economy. Startups innovate, by running semi-scientific experiments to test the effect of new strategies and technologies on problems in the real world. They figure out the right combination of incentives, rules and actors to generate economically valuable activity, and there’s an incredible illustration of this by Eric Stromberg on Medium called the Startup Idea Matrix. In this chart, rows are markets and columns are strategies. Cells contain examples of leading companies that have successfully applied the strategy to the market. For example in the ‘User Generated Content’ column, we have the following market examples:

In the ‘Shopping’ row, we have the following strategy examples:

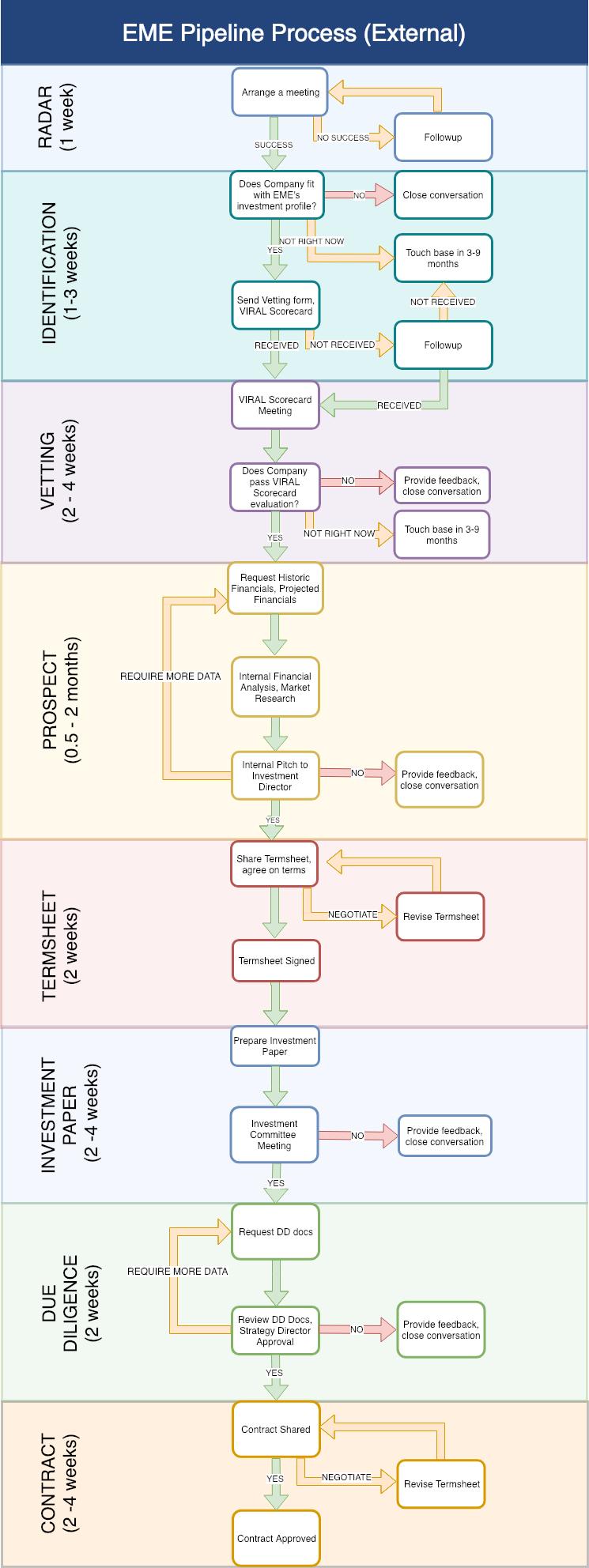

What’s fascinating about the chart is just how much of it is empty. Cells could be empty because that strategy/market combination hasn’t been tried before, or more likely, it hasn’t worked (yet). Note that over 90% of startups fail within 5 years, an incredibly high failure rate which is justified by the huge potential reward for figuring out the right strategy-market combination. Also note that this matrix can and will change over time, as new technologies are invented. For example, the smartphone brought about a wave of new companies and apps that all sought to exploit the new opportunities created by mobile internet-connected devices. Only a small number actually figured out a winning strategy on a global scale - Uber for transportation (in some places), Whatsapp for messaging, Strava for social fitness etc. Even with such terrible odds, systematic experimentation with new strategies and technologies should be the goal of every startup ecosystem, because this produces the economy of tomorrow. We often talk about obliquely about this idea as a venture capital firm, saying “Someone should create a startup to solve X problem in that industry. It’s going to happen sooner or later.” Startups often refer to it when they say they are the “Uber for X”, meaning they are testing the strategy of Uber (on-demand, location-based) on a different market or industry, thereby solving a new problem. Due to barriers of infrastructure and language, a miniature version of this idea matrix could be made for almost every country. There is plenty of low-hanging fruit in Myanmar in terms of proven business models that have worked overseas, and in a future post, we’ll be sharing our top startup ideas that we think could work in Myanmar. We don’t guarantee the success of any of these ideas, but we’d love to chat to anyone attempting them. Who knows, they might just become Myanmar’s first unicorn. Fundraising for an early-stage startup is hard. Entrepreneurs spend lots of time crafting their message, making decks, networking, pitching and responding to requests for further information, all the while building a product and growing a team. And after several months of hard work, entrepreneurs may end up with nothing for all that effort. On the other side, investing in early-stage startups is also hard. Investors meet hundreds of startups per year, and only a small fraction of them will be alive in 5 years. There is little data and lots of uncertainty, and because VCs have investors too, they look for ways to minimize risk and maximize reward. This combination of incentives often leads to a dysfunctional system, where startups and investors both play shotgun, entering into as many conversations as possible in the hopes that one may succeed. Investors may string startups along for many months without making clear decisions, while startups may start fundraising before they are prepared and ready. The main divide to bridge therefore becomes one of communication and expectations. In this light, we have decided to publish our refreshed pipeline process, which aims to be as transparent and productive as possible. By highlighting all the stages and requirements, as well as the decision points, we hope to contribute some clarity on VC investment (or at least, our approach to VC investment). As can be seen from the chart, the process is reasonably complex - the minimum time for an investment is 3 months, although realistically it can take up to 6 or 8 months. There are also five major decision points, with increasing levels of certainty in later stages of the process. Note that this investment process isn’t for everyone - startups select investors just as much as investors select startups, and if some are put off by the complexity, that’s a good indication that a future relationship wouldn’t have worked out. That said, at all times we take our role in the startup ecosystem seriously and will always coach good startups through the process and provide feedback if and when we stop the process.

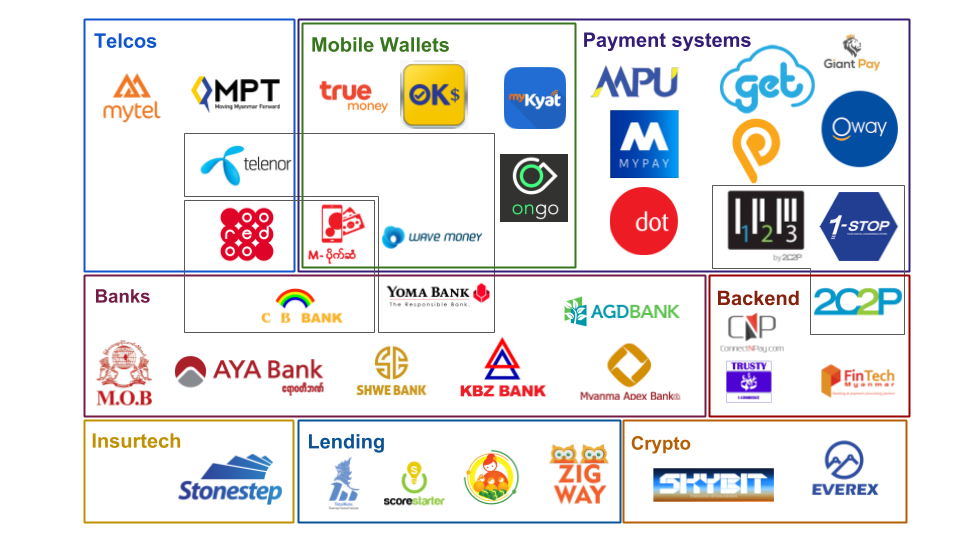

Taking on institutional capital is a big commitment, but we hope our pipeline process is a positive first engagement, and a taste of the value we can bring to our portfolio companies. We are thorough in our selection just as we’re thorough in the support and mentorship we provide our portfolio. Receiving investment from EME is not the end of a process, but the start of a journey of support, guidance and collaboration that is 100% directed at scaling great startups. Paying for houses and cars in huge pallets of cash is normal in Myanmar right now, but will be almost unimaginable in just a few short years. Financial technology in Myanmar is at a critical inflection point - many players have thrown their hats into the ring and are innovating in order to win customers and digitize a highly cash-based economy. We’ve attempted to map out the current state of the Myanmar fintech landscape below - see how many of the companies you know! As can be seen from the map, payments are especially messy - mobile wallets (Wave, OKDollar etc) are competing with cash acceptance networks (Reddot, 123), banks (AGDPay, KBZPay), card networks (MPU, Visa) and platforms (Oway, Get) in an all-out war to gain traction, although cash is still the main competitor, accounting for over 99% of ecommerce transactions. We expect to see a lot of consolidation in the next 2-5 years, with a digital payment adoption rate that mirrors the trajectories of other countries in the region like Thailand and Indonesia.

One of the major challenges is a lack of financial infrastructure, for example interbank transfers and credit bureaus, although progress is being made on these fronts, aided by new regulation from the government. The fintech ecosystem is evolving rapidly, and overall we think it’s in a healthy state. As adoption rates climb, everyone will reap the benefits of increased convenience and efficiency, driving growth in the economy as a whole. We’re looking forward to seeing how it all plays out. See full list of sectors and players below: Telcos: MPT, Telenor, Ooredoo, MyTel Mobile Wallets: Wave Money, M-Pitesan, True Money, OnGo, OKDollar, MyKyat Payment Systems: MPU, MyPay, Reddot, Get Digital Store, Paypoint, 123, 1stop, Giantpay, Oway Banks: MOB, Aya, CB, Shwe, KBZ, Yoma, MAB, AGD and more Backends: ConnectNPay, 2C2P, Trusty E-commerce, Fintech Myanmar Insurtech: Stonestep Lending: Thitsaworks, Scorestarter, Mother Finance, Zigway Crypto: Skybit, Everex Having a Singapore-registered holding company is fast becoming an industry standard among Myanmar and other Southeast Asian startups. At EME for example, we invest from our Singapore holding company into startups’ Singapore registered holding companies because Singapore offers efficient processes for company incorporation, share transfer, as well as tax benefits. However, being registered under the Singapore Company Act comes with certain ongoing responsibilities, namely the filing of the Annual Return on a yearly basis after incorporation. The Annual Return is the electronic filing process to submit required information to Singapore’s Accounting and Corporate Regulatory Authority (ACRA). It includes:

Annual General Meeting An AGM must be held once every calendar year. The deadline for an AGM is 15 months from the date of the last AGM. If the company is newly incorporated, it is allowed to hold an AGM within 18 months from the date of the incorporation. Necessary topics for discussion at the Annual General Meeting include:

Up-to-Date Financial Statements At the AGM, financial statements not older than 6 months have to be handed to the Board of Directors. The Financial statement must consist of the following documents:

The company needs to file the Annual Return within one month of holding the AGM. For Annual Filing, the company will usually need to file the financial statements in XBRL (Extensible Business Reporting Language) format, via Bizfile (ACRA's online business reporting system). Since the Myanmar subsidiary company is most likely to be owned 99% by the Singapore holding company (now it can be 100% because the new 2018 Myanmar Companies Law does not require foreign companies in Myanmar to have a local director), the financial reports must be consolidated i.e the Financial Reports of both the Singapore and Myanmar entities. This annual filing process can seem like a daunting process for entrepreneurs. As part of EME's incubation services, we help our portfolio companies to meet the compliances of both Singapore and Myanmar Company Acts. Maintaining regulatory compliance and gtting the books right is a must-do for startups with ambitions to scale. An interesting pattern has cropped up as we comb through our EME database of all the startups and investments in Myanmar from 2012 onwards: we can identify three distinct waves of startups based on time, product and business model. The first wave: fundamentals

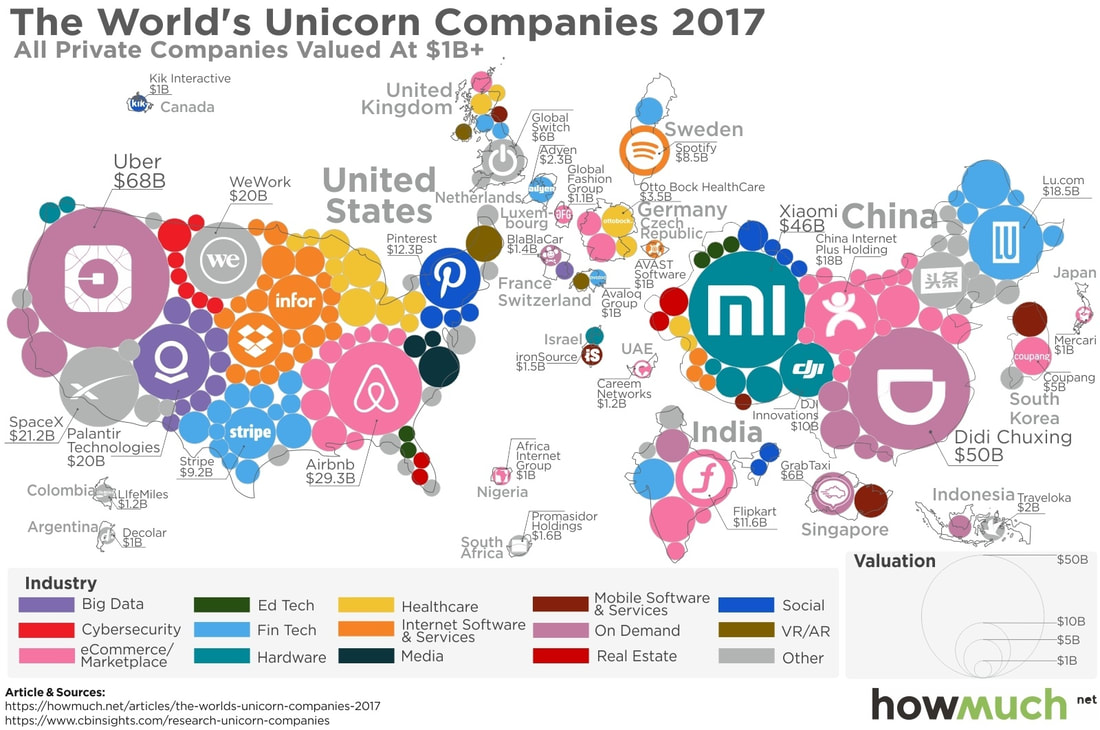

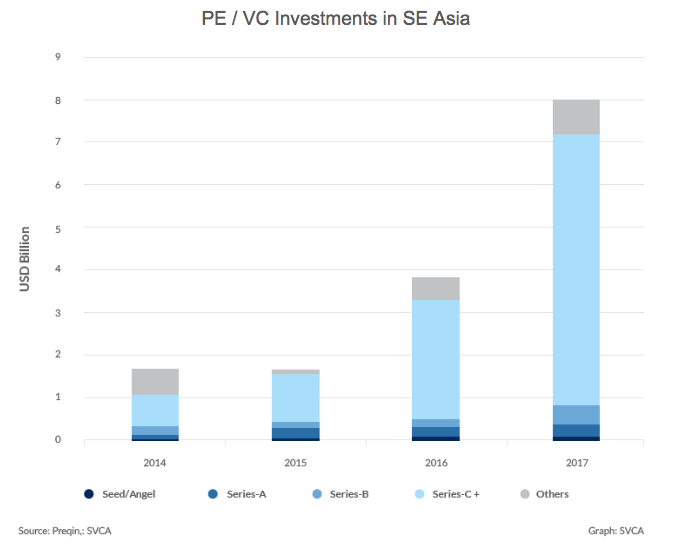

Founded from 2012 to 2014 or so, the first wave of startups were the fundamental consumer internet platforms, mostly online marketplaces for cars, jobs, houses and travel. Often founded by repatriates who had worked in Singapore or the West, these companies included CarsDB, iMyanmarHouse, Oway and MyJobs, as well as more pure-technology companies like Bagan Innovation Technology (Myanmar-language keyboards) and Nexlabs (software development). Rocket Internet entered the market aggressively in 2013 with a stable of platforms including house.com.mm, motors.com.mm, ads.com.mm and more, none of which are still alive today except Shop.com.mm, which is now owned by Alibaba. Honourable mentions go to the nascent social networks and chat apps which didn’t have much of a chance against the blue tide of Facebook that swept the country. Most of the first wave companies are either dead or dominant by now, although new competitors can enter their markets at any point. The second wave: niches From 2015 till 2017, the second-wave was defined by more niche value propositions. There was still a lot of low-hanging fruit to be picked by replicating successful overseas models in more specialized markets. These include companies like Joosk Studio (digital animation and illustration), Bindez (search engine & news aggregator) and Bagan Hub (B2B ecommerce). BODTech also made a round of investments in Flymya (travel), YangonD2D (food delivery), Innoveller (bus ticketing) and more. Also included in the second wave were fintech plays, often by corporates or regional entities. These include large companies like Wave Money, Reddot, Ongo etc, all trying to stake out territory in the digital payments market. Many of these companies are beginning to see real traction, as they carve out their niche in the rapidly growing digital economy. The third wave: experiments We are seeing from now onwards a third wave, defined by greater experimentation, either with business models or with technology. Witness Expa.ai (chatbot builders), RecyGlo (recycling-as-a-service) or Mote Poh (employee rewards coupons). While some of these models have yet to be validated, the ecosystem is in a healthy state as entrepreneurs continue to innovate. Some of this experimentation has been made possible by the entry of institutional investors and accelerators, for example Phandeeyar, whose accelerator program has graduated 11 startups and counting. The incubator / accelerator space is becoming increasingly crowded, with Rockstart Impact, SeedStars, Impact Hub and more beginning to make their presence felt. EME sees opportunities across all three waves of startups. CarsDB, one of our first two investments, is a leading member of the first wave as undisputed #1 in online car classifieds. Our other portfolio company, Joosk Studio is a definite second-wave company - providing a first-of-a-kind product in a specialized field with opportunities for further expansion. We’ll continue to look for companies across this whole spectrum as the Myanmar startup ecosystem develops further. Join the conversation on our Facebook page to let us know your thoughts. We have an office bet going on here at EME. Over lunches at MICT Park and long cab rides to downtown, we discuss the following proposition: Myanmar will create a unicorn (a company with a valuation over $1 billion USD) within the next 5 years. The stakes are a round of beers for us and possibly much higher for the market at large. Disclaimer: we’re not talking about existing companies or prospective investments (that’s a separate bet), so much as the overall trends and market conditions that would allow a unicorn to emerge. As anyone who has stood in line at a Myanmar government office can tell you, there are significant structural challenges for startups to solve. Nevertheless, the population is large, young and increasingly digitally-connected, and as McKinsey suggests, the economy could enjoy years of strong catch-up growth over the next decade in line with other countries in the region like Indonesia and Vietnam. This creates a long-term opportunity for a local tech company to grow into a unicorn. Sector-wise, the startup would probably be in transportation, ecommerce or fintech. All of these sectors have large market sizes, viable business models and can use technology to scale. While other sectors (healthcare, education, logistics etc) also have large potential markets, they are often more challenging to digitize and/or monetize. For funding, this prospective unicorn would probably get seed investment from angels and local funds like EME, then tap regional VC funds and family offices for Series A / Series B. Corporates and later-stage PE/VC investors e.g. Alibaba, Softbank, Sequoia, would fill out the later rounds. Investors are increasingly interested in Southeast Asia and have a lot of unspent capital. As long as this prospective unicorn could demonstrate strong user growth and potentially expansions to other countries in the region, access to finance wouldn’t be an issue. Of course for the purposes of the bet, the potential unicorn would have to avoid getting acquired before reaching that magic $1b valuation. Even after reaching unicorn status, a company may stay private for many years (now often referred to as the Softbank Effect after SoftBank’s $100 billion Vision Fund). Acquisitions by major global platforms seem to be preferred to IPOs at present. Nevertheless, the recent listings of Sea, Razer and Kioson prove that IPOs can be viable for Southeast Asian technology companies.

Overall, we’re very optimistic about Myanmar’s prospects for a unicorn in 5 years. As long as startups continue to work hard, engage users and build products that generate real value, the chances are good that a local player can grow sufficiently fast to achieve unicorn status. It may come as no surprise then, that EME is investing in and supporting early stage tech companies. If you want to join the bet, take our poll on Facebook. See you for beer in 5 years. Thank you to everyone who came to EME's official launch on October 31 at the Penthouse and helped make it such a success! Over 80 of you came for an evening of networking and celebrating the founding story of EME. We’re excited to be announcing our two initial investments: Joosk Studio is the leading animation and illustration company in Myanmar. Their sticker packs have been downloaded millions of times, and their weekly animation series have regular audiences in the thousands. With a roster of international clients including Facebook, UN agencies and leading corporates, as well as a talented team of young designers, Joosk is defining the new wave of digital entertainment in Myanmar.

CarsDB is the #1 online platform for buying and selling cars in Myanmar. Founded in 2012 by an experienced team of local repatriates, CarsDB has grown into the undisputed leader of a rapidly growing market. With a wide range of services including classifieds, offline auto shows and product listings, and plans to expand into insurance and car rentals, CarsDB is the hub of everything automobile-related in Myanmar. It’s been a long road since our founding investors met in 2015 and decided to launch a new Myanmar-focused fund. After much hard work, the partners have developed a compelling vision and set of resources for supporting young Myanmar entrepreneurs to build transformational companies. We’ve met over 100 companies and organisations since commencing operations at the beginning of 2018, and will continue to engage actively with the community through meetings, events and workshops. As part of our launch, we’re also kicking off our official blog and monthly newsletter (subscribe here). With a mix of opinion, data analysis and curated news articles, we hope these will become valuable resources for the startup and investor communities in Myanmar. As always, we are very open to feedback and requests so tell us what you’d like to hear more about. Please don’t hesitate to reach out if you’d like to know more about EME or the startup ecosystem in Myanmar, or want to discuss opportunities to collaborate. All the best,

|

Categories

All

Archives

September 2020

|

RSS Feed

RSS Feed